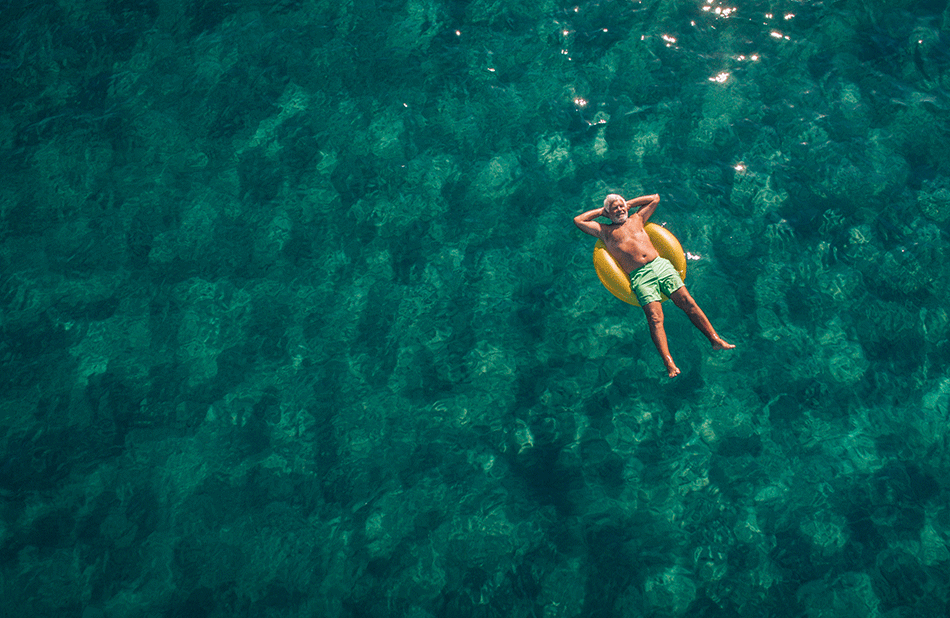

An Active Retirement

We’ve all heard that exercise is good for us, but what about as we get older? Over the course of a career spent working countless hours and long nights, we may have gotten somewhat out of shape. We might think it’s too late to get back into shape by the time we’re retired, or pointless to carve out time for physical activity, but this isn’t true. Incorporating more physical activity into your day could be a [...]